HEALTH INSURANCE CLAIM REJECTED Part:1

- Fri Dec 20 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

THE ULTIMATE GUIDE TO TACKLE REJECTION (PART-1)

It can be distressing when your health insurance claims get rejected, and you end up paying for the treatment costs from your pocket. It can also provoke a sense of panic and uncertainty about your healthcare coverage. But Understanding the reasons behind these claim denials will empower you to navigate the complexities of health insurance more effectively and helps you avoid similar situations in the future.

Insurers need precise details to process claims, and any discrepancies can result in delays or denials. Our clients frequently face these rejections, and despite our efforts to seek reimbursement, we often cannot resolve the issues due to errors on the insured's part. In spite of numerous reminders and requests, our clients neglect to mention or fail to disclose existing health conditions as serious as diabetes, asthma, COPD, and others.

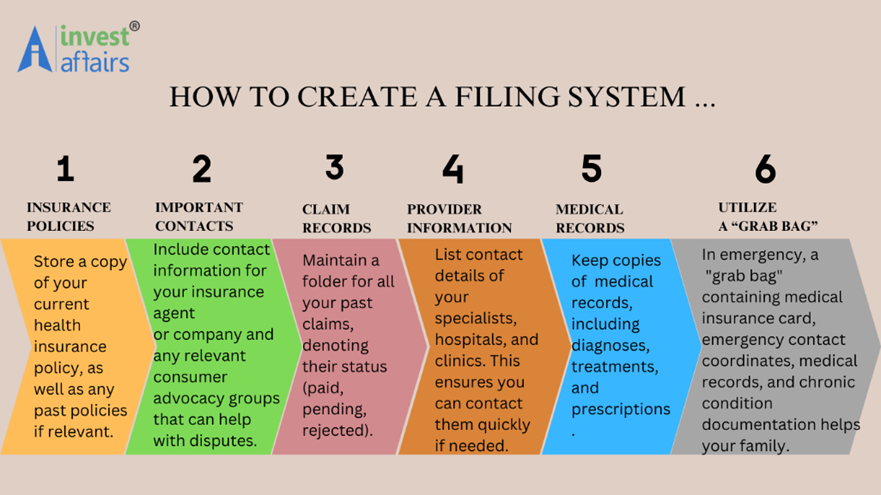

So, first things first. Once you have bought or renewed a policy, meticulous record-keeping is key to ensuring that all necessary information is easily accessible when needed, particularly in times of illness or emergency.

Here’s a more elaborate guide on why and how to organize your medical insurance documents effectively :

IMPORTANCE OF RETAINING DOCUMENTS

CLAIMS PROCESSING:

When filing claims, having all relevant documentation at hand—such as policy numbers, previous claims, and submitted medical records—can expedite the processing time. This helps ensure you receive prompt reimbursement or payment for medical services.

UNDERSTANDING COVERAGE:

Insurance policies can be complex, with different levels of coverage, exclusions, and terms. Retaining a copy of your policy and any rider documents not only helps you understand your rights and privileges but also assists in navigating potential disputes.

TRACKING MEDICAL HISTORY:

Keeping detailed records of medical treatments, prescriptions, and doctor visits can aid healthcare providers in delivering more informed care. This is particularly important for ongoing or chronic conditions.

SIMPLIFYING CAREGIVER ACCESS:

In times of illness, you may not be capable of communicating your insurance details or medical history. By storing this information in a centralized location, you can ensure that family members or caregivers can easily access it when necessary.

HOW TO ORGANIZE YOUR MEDICAL INSURANCE FILE

You may always choose to organize your files/ documents digitally or in a docket, according to your convenience but, at Investaffairs, we always insist on considering a combination of both. Digital copies provide ease of accessibility, while physical copies can be crucial if technology fails or certain situations where paperwork is prioritized and paper copies are required.

After going through the harrowing medical ordeal, the last thing you want is your health insurance claim being rejected. However, this is a possibility, especially if you do not fill the right information, submit the wrong documents, etc. Below we address two cases where our clients faced claim rejection.

Let us take a look at these two case studies first:

Case Study 1: A 45-year-old salaried individual purchased a comprehensive health insurance policy to safeguard his family’s health. The policy provided a sum insured of ₹Y lakh and covered hospitalization expenses, diagnostic tests, and post-hospitalization treatment. He diligently paid his premiums (for a period of four years) and believed he was adequately insured.

Incident

In December 2024 he was diagnosed with a severe gastrointestinal disorder requiring immediate surgery. He was hospitalized for 10 days, and the total medical bill amounted to ₹ X lakh. Confident about his policy, he submitted a claim to his insurer.

Despite having valid coverage, his claim was rejected. The insurer cited the following reasons for rejection:

- That his condition was a pre-existing illness and he was also diabetic which he did not disclose at the time of purchasing the policy.

- That the hospital failed to notify the insurer within the stipulated 24-hour window.

- That certain diagnostic test reports and prescription slips were missing.

The rejection left our client in financial distress, as he had to deplete his savings to pay the medical bills. It also caused emotional stress, as he felt he was backstabbed despite being a loyal policyholder, paying premiums for years.

However, he approached the Insurance Ombudsman for grievance redressal. Key findings during the resolution process:

- Medical History: The insured had no prior diagnosis of gastrointestinal issues, disproving the insurer’s claim of a pre-existing condition. Nevertheless, he had not disclosed that he was diabetic.

- Documentation: The insured provided the missing documents during the ombudsman's review process.

- Intimation Clause: The ombudsman noted that the hospital delayed the intimation.

- Non-Disclosure Clause: Undisclosed PED worked in favour of the insurer.

Our client is still fighting the case stating that the broker never insisted on a blood work while renewing the claim. Therefore, he was himself not aware of his spiked sugar levels.

Case Study 2 : A 52 year old housewife, held a health insurance policy with a sum insured of ₹Y lakh. The policy covered hospitalization expenses, diagnostic tests, and day-care treatments.

Incident

In June 2024, the lady in question experienced severe pain in chest, dizziness and twitching/numbness in nerves . Suspecting a cardiac issue, her husband rushed her to a nearby hospital. Her husband insisted on admitting her as a precautionary measure as the doctor suggested a series of tests to evaluate her condition. The doctors conducted an ECG, blood tests, and cardiac enzyme analysis and other tests to rule out a heart attack. Thankfully, the results were negative, and the patient was discharged the following day with advice to manage stress and monitor her condition along with some medication.

The total bill, including admission charges, diagnostic tests, and doctor’s fees, amounted to X amount. Her husband submitted the claim to his insurer.

The insurer rejects the claim. Why ?

- The insurer argued that the condition could have been managed through outpatient consultations and did not warrant hospitalization.

- The policy excluded claims for admissions done solely for diagnostic purposes without subsequent treatment.

The couple was shocked and felt the rejection was unfair, as the hospitalization was done based on medical advice...

To fight the rejection:

- Obtained Doctor’s Certification: Her doctor provided a written statement explaining the necessity of hospitalization due to the risk of a cardiac event.

- Referred to Policy Terms: Our client highlighted that the policy covered emergency admissions and diagnostics in cases of suspected life-threatening conditions.

Our client escalated the issue to the Insurance Ombudsman, who reviewed the case and ruled in her favour. The ombudsman emphasized that denying a claim in genuine emergency cases undermines the policyholder’s rights. The insurer was directed to settle the claim.

LET US EXPLORE THE REASONS WHY YOUR HEALTH INSURANCE CLAIM CAN GET REJECTED

Lapsed Policy

Incorrect Information

Filing Claim During The Waiting Period

Hiding Information About Pre-Existing Diseases

Delay In Filing The Claim

Insufficient Documentation

Exhaustion Of Sum Insured

Out Of Coverage

False Information

No Pre-Authorisation From The Insurance Company

Treatment Received In Blacklisted Hospitals

Latest Medical Test Reports Unavailable

Undergoing regular medical tests can help you stay informed about your health, and accordingly, customize your insurance plan to get maximum coverage. A medical test can be considered as a proof of the policyholder’s existing medical conditions, and it can significantly reduce the chances of the claim getting rejected.

Whenever you encounter a rejection, you can approach the insurer's grievance cell. If you don’t receive a response in 30 days or it is unsatisfactory, you can make a representation with the Regulator.

How to Avoid Claim Rejections

Here are some ways to avoid claim rejection in health insurance –

Renew your policy on time for continuity in coverage. Insurers generally send reminders at least 15 days prior to the policy’s expiry date. So, as soon as you get the reminder, pay the premium for renewal of the policy.

If it’s a cashless claim, you need not worry about the payment because the insurer will settle it directly with the hospital on the day of discharge. However, if it’s a reimbursement claim, you must submit the claim form along with the required documents within 15 days after discharge from the hospital. The timeline can differ from insurer to insurer.

Read the policy document carefully to understand the terms and conditions of coverage.

Inform the insurer on time. If it’s an emergency hospitalisation, notify the insurer within 24-48 hours of getting hospitalised; in case of a planned hospitalisation, you must inform the insurer at least 2-3 days in advance.

When a claim gets rejected, it can get stressful. So, to avoid claim denials, you must be aware of the steps mentioned above and reduce out-of-pocket expenses.

POLICIES COVERING CRITICAL ILLNESS AND CANCER

Insurance companies offer a variety of health plans tailored for individuals, families, parents, seniors, and women. There are plans to cover critical illnesses and the much dreaded big C. Especially if you know of a family member who has fought this battle. Cancer is a monster which not only eats your body, but it also feeds on your soul, your mental strength and depletes the life savings of you and your family.

Cancer insurance can serve as a valuable supplementary option alongside your current health insurance policy, especially if you have a family history that indicates an average risk of developing cancer. By opting for a cancer-specific insurance plan, you may benefit from lower premiums compared to traditional health insurance, while still addressing your financial needs.

Assessing personal health risks, lifestyle factors, and regional healthcare costs is vital in determining the right level of coverage. Ultimately, securing adequate health insurance can be a proactive step towards safeguarding your family's financial future while allowing for peace of mind in the face of uncertainty. It's wise to engage with insurance professionals, conduct thorough research, and take the time to understand the specifics of your chosen plan to ensure it meets your unique needs.

P.S. Kindly regard this write-up as work in progress. Will be updated as and when required.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts